Is a Calmer Market Coming?

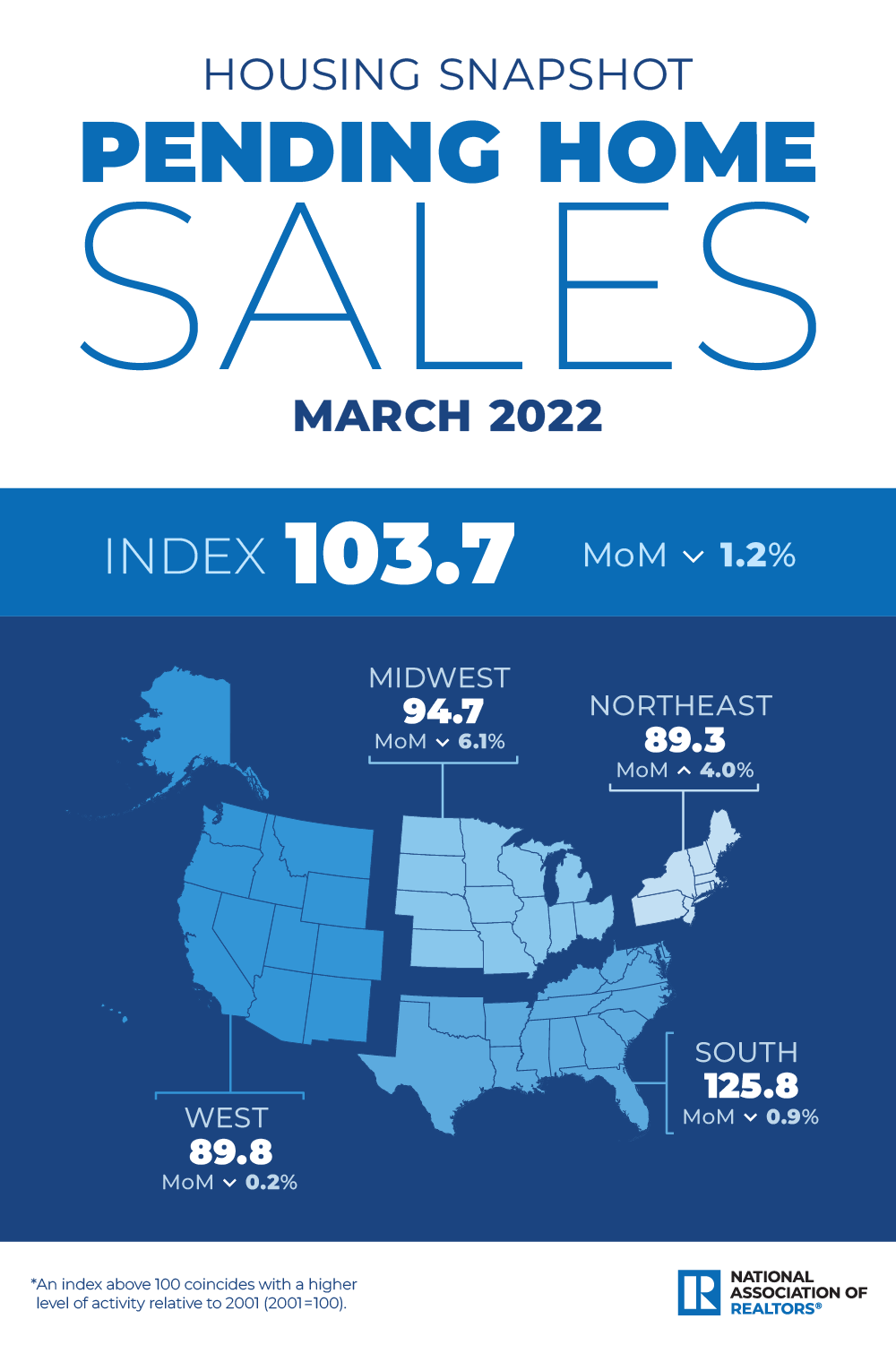

The housing market is showing some early signs of normalizing. Contract signings dropped in March, the fifth consecutive month that pending home sales have fallen, the National Association of REALTORS® reported Wednesday. The Northeast was the only major region of the U.S. that saw a monthly increase in contract signings. All other regions dropped.

“The falling contract signings are implying that multiple offers will soon dissipate and be replaced by much calmer and normalized market conditions,” says Lawrence Yun, NAR’s chief economist. “As it stands, the sudden large gains in mortgage rates have reduced the pool of eligible home buyers, and that has consequently lowered buying activity. The aspiration to purchase a home remains, but the financial capacity has become a major limiting factor.”

NAR’s Pending Home Sales Index, a forward-looking indicator of home sales based on contract signings, dropped 1.2% in March to a reading of 103.7. (An index of 100 is equal to the level of contract activity in 2001.) Overall, contract signings fell 8.2% year over year in March.

The drop comes at a time when inflation is running at a 40-year high and living costs are rising. (Read more: Inflation Edges Higher, Affecting Housing.) Yun expects inflation to average 8.2% in 2022. He predicts that it will start to moderate, however, to 5.5% in the second half of the year.

Home buyers are also facing higher borrowing costs. Yun predicts the 30-year fixed-rate mortgage to average 5.3% by the fourth quarter of this year. He expects rates to average 5.4% by 2023.

Higher mortgage rates and sustained price appreciation has led to a year-over-year increase of 31% in mortgage payments in March, according to NAR’s data.

“Overall existing-home sales this year look to be down 9% from the heated pace of last year,” Yun says. “Home prices are in no danger of decline on a nationwide basis, but the price gains will steadily decelerate such that the median home price in 2022 will likely be up 8% from last year.”

Rental costs are also surging higher. Monthly payments have soared, and Yun predicts more renters will explore homeownership as a result to the higher costs.

“Fast-rising rents will encourage renters to consider buying a home, though higher mortgage rates will present challenges,” Yun says. “Strong rent growth nonetheless will lead to a boom in multifamily housing starts, with more than 20% growth this year.”

Source: National Association of REALTORS®

©National Association of REALTORS®

Reprinted with permission