Sellers Dropping Asking Prices

Some homeowners may need to reset their price expectations. Signs of a slowing real estate market are growing across the country—existing-home sales and new-home sales are falling as well as pending home sales. Pending home sales fell for the sixth consecutive month in April and are now at the slowest pace in nearly 10 years, the National Association of REALTORS® reported last week.

Homes are still selling fast but a slowdown is evident in many markets. Amid rising mortgage rates that are pricing more buyers out, some home sellers are having to revisit their asking price.

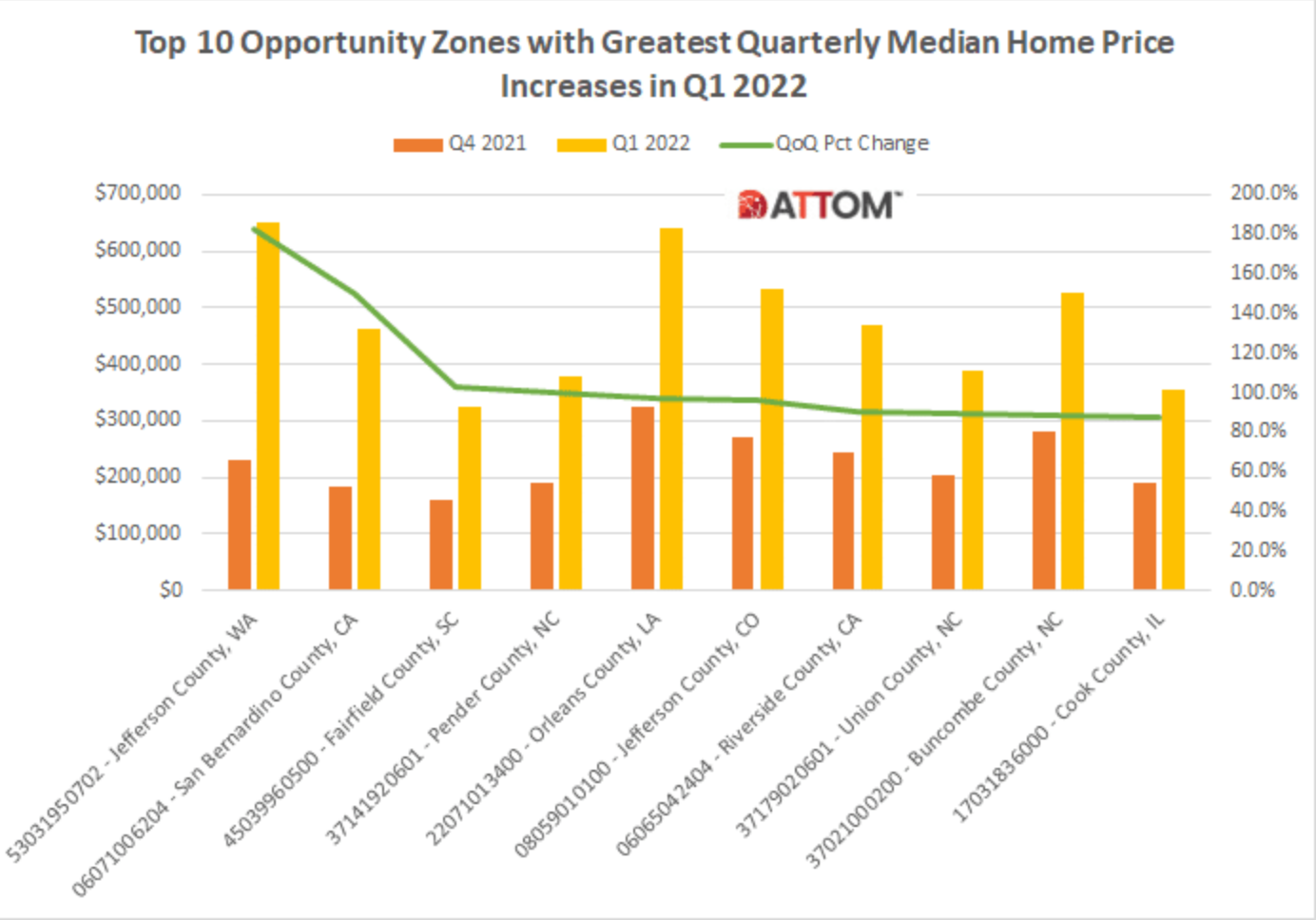

Price drops are particularly more common in migration hotspots, places that have been relatively affordable but saw home values surge as more people have migrated in from coastal areas since the pandemic began, a new report from Redfin says. For example, in Boise, Idaho, home prices are up 62% over the past two years. In April, 41% of home sellers dropped their prices, the largest of 108 metro areas tracked by Redfin.

More than 20% of home sellers dropped their price in April in seven of the 10 most popular migration destinations, the report says. Other areas that are seeing a rise in price drops include Cape Coral, Fla. (at 33% in April); New Orleans (32%); Baton Rouge, La (31%); and Sacramento, Calif. (30%).

“Many places like Boise or Sacramento that saw a surge in migration and a sharp increase in home prices over the past two years have now seen an abrupt drop-off in demand, leading sellers to drop their prices with increasing frequency,” says Daryl Fairweather, Redfin’s chief economist. “When mortgage rates were at or below 3%, both local and out-of-town home buyers were more willing and able to tolerate high prices, but at 5%, many are priced out. A home’s price is driven by the balance of supply and demand, and when demand drops off and supply increases like it is now, rapid price increases evaporate quickly.”

Lawrence Yun, NAR’s chief economist, said in a recent release on the latest housing data that higher mortgage rates have increased the cost of purchasing a home by more than 25% compared to last year. In many cases, that could mean the higher mortgage payments are leading up to $500 more per month for borrowers. Further, higher home prices add another 15% to that figure, Yun says. Also, households are facing rapid inflation that is increasing everyday costs, like fuel and food.

Source:

“Home Sellers in Migration Hotspots Increasingly Turn to Price Drops,” Redfin (May 27, 2022)

©National Association of REALTORS® Reprinted with permission